Introduction

Elevating Client Service and Ensuring Compliance in China for Financial Institutions

In China’s financial services sector, maintaining personal client connections while adhering to stringent regulatory requirements is a critical challenge. This case study explores how CLD empowered a Global Financial Services Firm to enhance client service, ensure brand safety, and streamline compliance through a strategic WeCom solution integrated with Salesforce Sales Cloud.

The Challenge

Balancing Personal Connection with Regulatory Compliance

In China, direct communication via WeChat is a preferred method for building client relationships, especially in the financial services sector. However, using personal WeChat accounts for clienteling presents significant challenges.

Key challenges included:

Compliance Risks

Unmonitored private chats on personal WeChat accounts create regulatory and compliance risks.

Lack of Centralized Data

Client interactions are siloed within individual agent accounts, hindering the ability to track customer engagement and gain valuable insights.

Brand Safety Concerns

The lack of oversight on personal WeChat communications raises concerns about brand safety and consistent messaging.

Scalability Issues

Managing client relationships across numerous personal WeChat accounts is difficult to scale and manage effectively.

The Solution

CLD’s WeCom (formerly WeChat Work) Integration with Sales Cloud

CLD partnered with a financial services firm to implement a solution that leverages WeCom (WeChat Work) and integrates it with their Salesforce Sales Cloud instance. This approach allowed the firm to maintain personal connections with clients while addressing compliance and data management challenges.

Key solutions included:

Secure and Compliant Clienteling

Enabling personalized client interactions within a secure and compliant WeCom environment.

Seamless Sales Cloud Integration

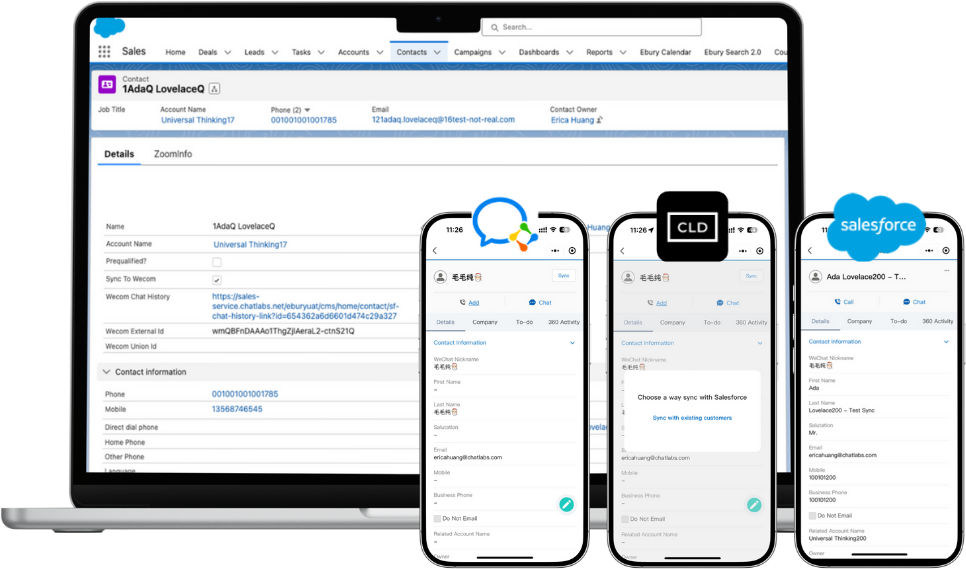

Integrating WeCom data with Salesforce Sales Cloud for a unified view of client interactions and enhanced CRM capabilities.

Comprehensive Chat Archiving

Providing chat archiving capabilities to ensure brand safety, regulatory compliance, and gain insights into the China market.

Mobile CRM Access

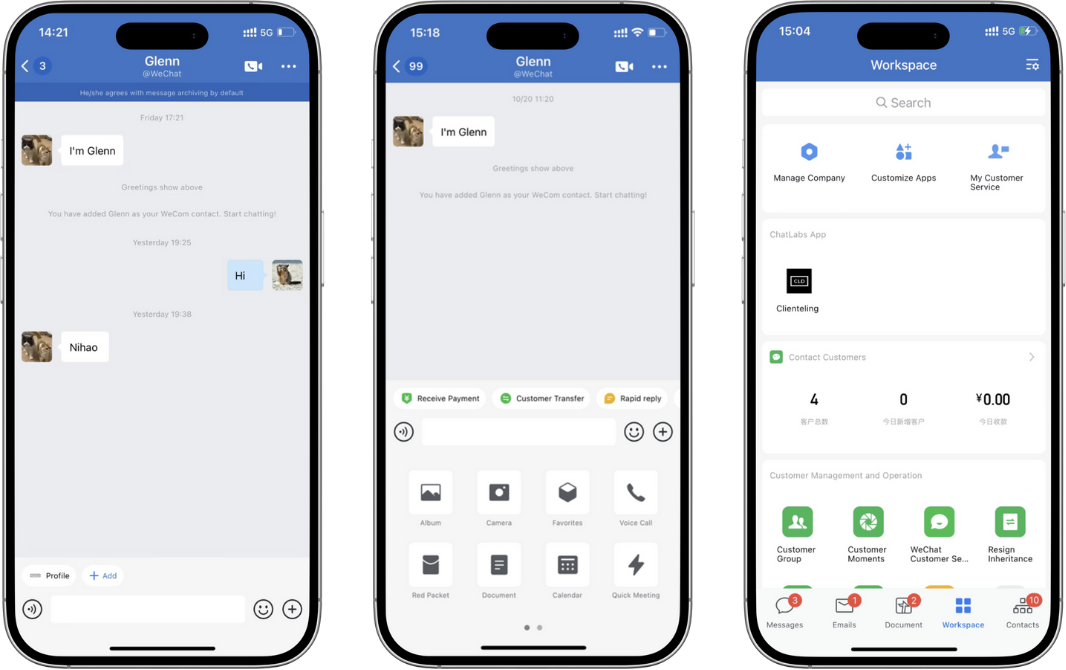

Empowering agents with mobile CRM functionality through a clienteling mini-program within WeCom.

Enhanced Data Visibility

Providing headquarters with greater visibility into client interactions and market trends.

Key Features of CLD’s Solution

Verified WeCom for Secure Clienteling

Establishing a verified WeCom account enables secure, one-on-one client conversations, building trust and legitimacy.

Consent & Compliance Features

Implementing consent mechanisms and compliance features within WeCom to ensure adherence to regulatory requirements.

Chat Archiving

Implementing chat archiving capabilities to ensure brand safety, regulatory compliance, and provide headquarters with insights into the China market.

Sales Cloud Integration with WeCom in China

Integrating WeCom data with Salesforce Sales Cloud to provide a centralized view of client interactions and enhance CRM capabilities.

Mobile CRM Functionality

Providing agents with mobile CRM functionality through a clienteling mini-program within WeCom, enabling them to access and update lead information on the go.

Enterprise-Grade Tools

Providing agents with a wealth of enterprise-grade tools within WeCom, such as task management and contact management features.

The Results

Compliance and Enhanced Client Relationships with High Net-worth Individuals in China

Improved Client Relationships

Agents were able to maintain personal connections with clients through direct communication on WeCom.

Reduced Compliance Risks

The firm mitigated compliance risks by using a secure and monitored communication platform.

Enhanced Data Visibility

Headquarters gained greater visibility into client interactions and market trends through the Sales Cloud integration.

Increased Efficiency

Agents were able to manage client relationships more efficiently with the help of enterprise-grade tools and mobile CRM functionality.

Strengthened Brand Safety

The firm strengthened brand safety by ensuring consistent messaging and oversight of client communications.

Your Partner in China

Empowering Financial Services Firms in China

By partnering with CLD, the Global Financial Services Firm successfully navigated the complexities of client communication and compliance in China. The integrated WeCom solution has not only enhanced client relationships and improved efficiency but has also mitigated regulatory risks and provided valuable insights for headquarters. For financial institutions seeking to thrive in China, CLD offers a comprehensive suite of solutions that deliver tangible results and a competitive edge.